Plastiq

Increase working capital and earn rewards on every bill

Leverage your existing credit card for payments to vendors who typically don't accept cards.

Pay Any Vendor

Use credit cards for rent, utilities, taxes, and more, even if they don't accept them directly.

Earn Rewards

Maximize credit card points, miles, or cash back on essential business expenses.

Improve Cash Flow

Access 60-90 day payment terms by unlocking working capital with their credit card.

Early Pay Discount

Gain the opportunity to negotiate with suppliers for early pay discounts since they receive the payment on time and how they requested (check, wire, ACH).

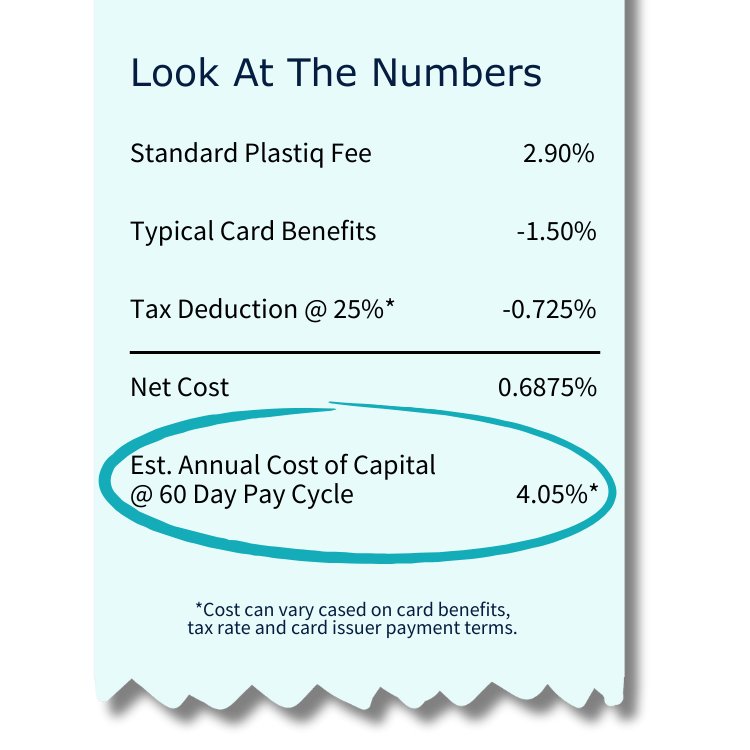

Unlock low-cost working capital with your credit card

With interest rates rising, keeping cash on hand by managing payables is critical. Plastiq by Priority maximizes your card program to pay all your suppliers, even those that do not accept cards. A win win for you and your suppliers.

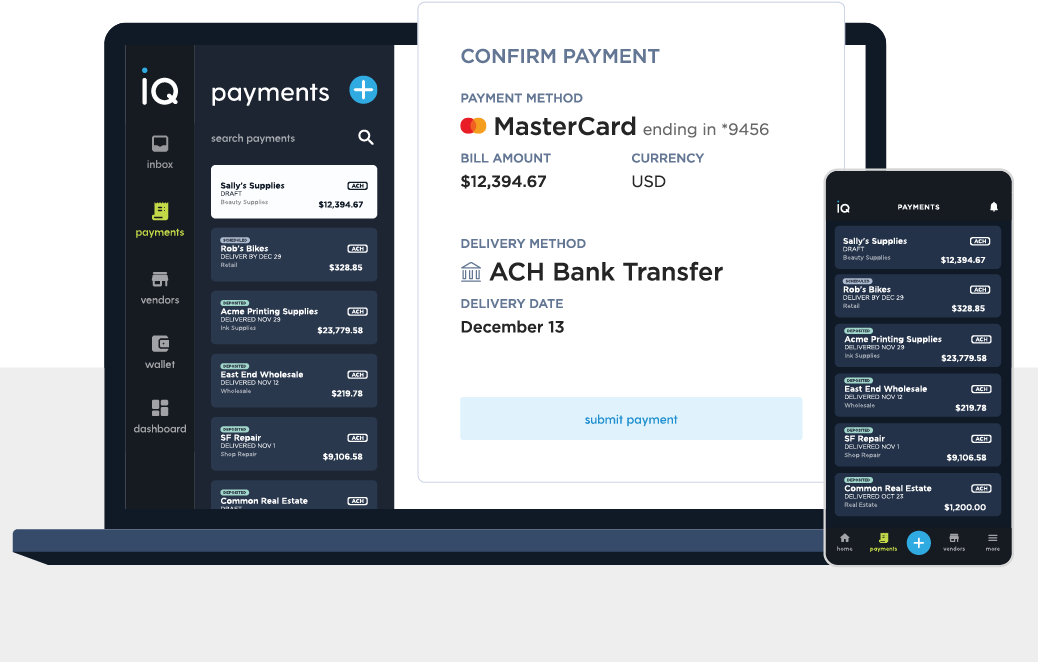

How Plastiq Works

Step 1

You select the suppliers to pay using your credit card or existing processes. Your suppliers do not need to sign-up.

Step 2

Plastiq processes your payments on your card or alternative methods.

Step 3

Plastiq pays your vendors on your behalf using check, ACH or wire.

Benefits to You

Unlock Working Capital

More Flexible Cash Management

More Flexible Cash Management

Optimize Rewards and Rebates

Streamline Payables Processes

Benefits to Your Suppliers

No Sign Up Necessary

Accelerate Timely Payments to Improve DSO

Automate Reconciliation

Happy buyers equals more business

Examples of Payment Categories

Inventory

Insurance

Rent

Media/Advertising

Shipping

Frequently Asked Questions

Get Some Answers

What is Plastiq?

Plastiq, Powered by Priority (“Plastiq”) is a leading B2B payments company, acquired by Priority on Aug 1, 2023. Founded in 2012, Plastiq has helped tens of thousands of businesses improve cash flow with instant access to working capital, while automating and enabling control over all aspects of accounts payable and receivable. Plastiq provides growing finance teams with technology and know-how once reserved for only large enterprises. The flagship product, Plastiq Pay, pioneered a way for businesses to pay suppliers by credit card regardless of acceptance as an alternative to expensive, scarce bank loan options.

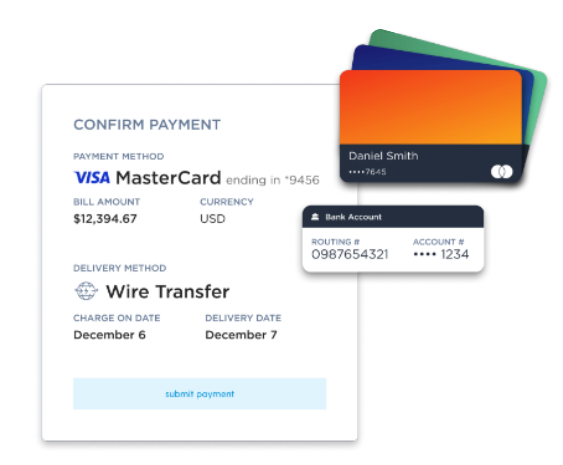

How does Plastiq work?

If a merchant wants to take advantage of their existing credit card limit, he/she would enter their credit card and supplier’s payment details (routing and account number, for example) in the Plastiq platform. The vendor receives a check, ACH or wire transfer as they have likely always received payments. From the merchant’s view, he/she sees the transaction + Plastiq fee show up on their

credit card statement. With the payment on card, the merchant doesn’t pay that bill until the credit card statement is due.

Do suppliers and vendors need to sign up?

Your merchants’ suppliers, those who have historically never accepted credit cards, do not need to be a part of the Plastiq ecosystem in order to receive their check, wire, or ACH from Plastiq.

What vendor/supplier categories can Plastiq send payment to?

Plastiq can send payments to domestic and international vendors, as well as send payments in USD or 22 dierent foreign currencies. Plastiq can be used for inventory, payroll, raw materials, ad spend,

consulting fees– virtually any B2B payment, good or service, that hasn’t historically accepted cards.

Does Plastiq have transaction limits?

Plastiq’s per transaction limit is the credit card limit or Plastiq’s Short Term financing pre-approved limit.

What term lengths does Plastiq offer?

Term lengths are determined by the credit card term lengths or chosen STF term lengths. If you have a NET 30 day credit card, for example, your bill is due 30 days after close of the statement. Using Plastiq with a NET 30 day credit card could give you 30-60 days of float.

Trusted by Hundreds of Growing Businesses

Be confident in an advisor who will fight to find you the right solution and support you along the way.

Insights From Our Clients

What Our Clients Are Saying

Michelle and her team did not “Sell” us a product or service. Rather, she educated us on parts of the payment business that we had no idea about and, in the process, offered us better solutions than we had at a more competitive price. She has followed up in the years since to ensure that we always have questions answered and that we are optimizing our options while minimizing costs.

Kevin Prior, Chief Financial Officer

Catholic Health Association of the United States

Michelle has taken care of our credit card processing for over 10 years. I can’t say enough about her commitment to customer service. She goes above and beyond to make sure we are taken care of and is always presenting new ideas to improve our online business needs. We love that she is so hands on and takes care of our needs.

Kelly Callier, General Manager

Callier's Catering

I have worked with Michelle Carr since 2012 and she has always offered top of the line customer service. Even when on vacation, she has found time to return my calls and help me out of a jam. She knows her stuff. I recently switched over to the Cash Discounting program, which has nearly eliminated my credit card processing fees. This lower cost solution has generated dollars that I can now invest back in to my business.

Gary Shenberg, Owner

Crest Bowl